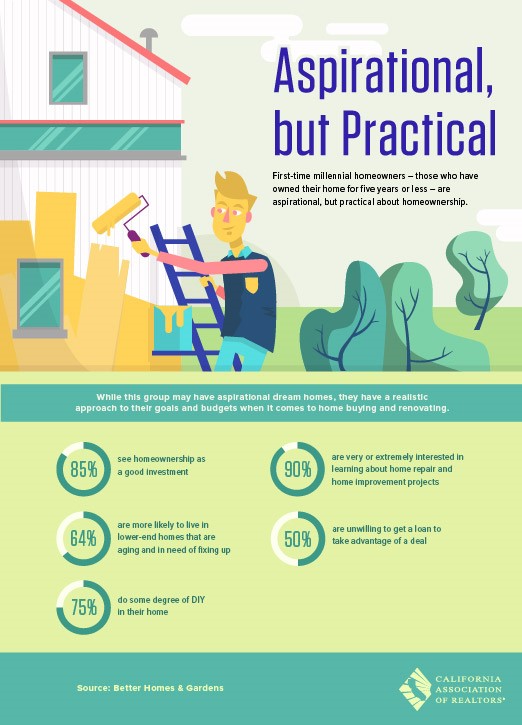

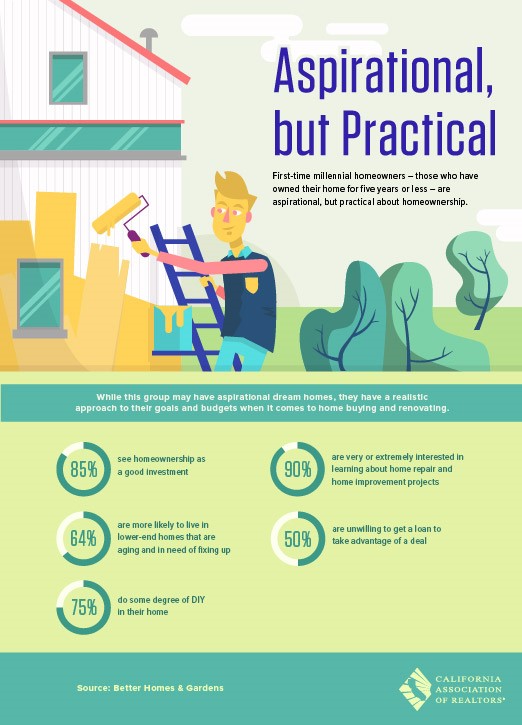

All eyes are on the largest generation of adults, Millennials. While their dream home ideals are sky-high, the approach they employ to budgets, goals, home-ownership and renovations shows their well developed practical side.

By Cathy McCabe

All eyes are on the largest generation of adults, Millennials. While their dream home ideals are sky-high, the approach they employ to budgets, goals, home-ownership and renovations shows their well developed practical side.

By Cathy McCabe

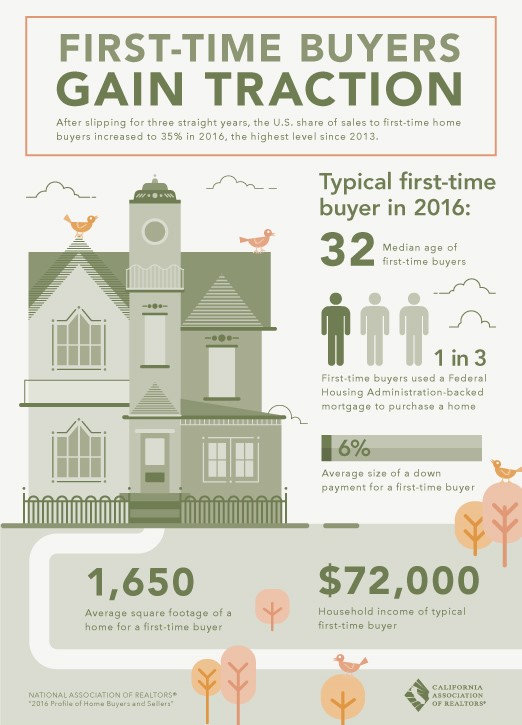

An interesting peek into some details of First-Time Homebuyers.

By Cathy McCabe

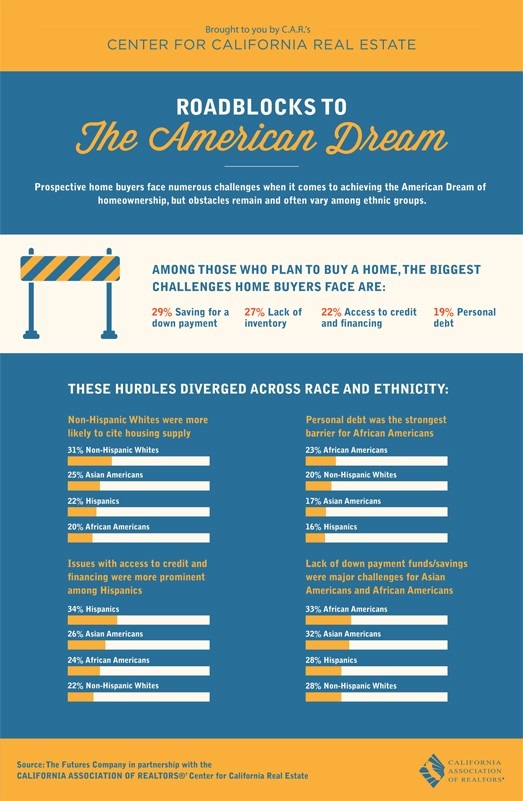

The American Dream can be a challenge to achieve. We can help find resources to overcome some hurdles, and share lots of information to help homebuyers make a plan to succeed. Give us a call!

The American Dream can be a challenge to achieve. We can help find resources to overcome some hurdles, and share lots of information to help homebuyers make a plan to succeed. Give us a call!

This article first appeared on Dailyfinance.com April 22nd, 2015

“Travis Hoium, April 22nd, 2015

If you’re looking to buy a home in the next year, you might want to do so before higher interest rates make financing such big-ticket purchases a lot more expensive. The Federal Reserve, which controls the supply of U.S. dollars and short-term interest rates, has indicated that it could start raising rates as soon as June.

Interest rates have been so low for so long that people might have forgotten what it’s like to pay “normal” interest rates of 6 percent to 8 percent for a loan. But if rates rise, the impact will be felt by nearly everyone trying to buy a home and even those trying to sell their home.

Interest Rates and Borrowing Power

When you apply for a loan at a bank, they try to assess your ability to pay back the loan given your income and the loan’s monthly payment. The higher your income, the larger the allowed payment, but interest rates play a big role in how large the payment will be. Even a slight rise in historically low interest rates could make it a lot more expensive.

Below, I’ve laid out the monthly payments for 15-year and 30-year $100,000 mortgages at different interest rates, not including any fees, like private mortgage insurance or property taxes. As you can see, a 1-percentage-point increase in interest rates from 4 percent to 5 percent on a 30-year mortgage results in a 13 percent jump in monthly payments. A 2-percentage-point increase results in an incredible 26 percent increase in monthly payments.

| Term | 4% Interest | 4.5% Interest | 5% Interest | 6% Interest |

|---|---|---|---|---|

| 15-Year Mortgage | $740 | $765 | $791 | $844 |

| 30-Year Mortgage | $477 | $507 | $537 | $600 |

The reason those higher payments are important is that they play into how much borrowing power you have. A bank is trying to figure out how much it can loan you and still expect you to pay it back on time, but the bank doesn’t necessarily care how big the loan is. What it really cares about is whether you can make the monthly payment.

So, let’s look at how a constant monthly payment impacts the size of home you may be able to buy. Below, I’ve calculated the maximum loan that could be taken out for the corresponding payments and interest rates.

| Monthly Payment | 4% Interest | 4.5% Interest | 5% Interest | 6% Interest |

|---|---|---|---|---|

| $1,000 | $209,461 | $197,361 | $186,282 | $166,792 |

| $2,000 | $418,922 | $394,722 | $372,563 | $333,583 |

| $3,000 | $628,384 | $592,083 | $558,845 | $500,375 |

Even with the same monthly payment, a 2-percentage-point increase in interest rate reduces borrowing power by 20 percent. As rates rise, that could have a major impact on not only your purchasing power but the entire housing industry.

Why Interest Rates Would Hurt Housing

This dynamic among payments, interest rates and borrowing power could have a profound impact on a housing market that’s still recovering from the recession.

When you get a mortgage, the amount you can borrow depends on how much money you make and how much the monthly payment of the mortgage will be. It’s no secret that wages haven’t risen much at all recently in the U.S., so recently the improving housing market has been driven by the borrowing power that low interest rates have provided rather than extra income from higher wages. If interest rates rise, even slightly, they could actually send home prices — and home values — lower, simply by reducing the ability of new buyers to pay for a home.

For millions of Americans, the impact of lower home values could be enormous because the home is the biggest asset a majority of Americans own. And since most people have a mortgage, it’s a leveraged asset, meaning losses are magnified.

If you buy a home with 20 percent down and then sell it a few years later but can only get 90% percent of the price you paid, your loss is half of your down payment. That’s a big loss on an asset that people don’t usually expect to lose money on.

Higher Interest Rates Are Coming — Someday

There’s no doubt that higher interest rates are coming someday; the challenge is that no one knows quite when they’ll arrive. With the economy and unemployment improving, the market is currently betting that the second half of 2015 will start to see higher interest rates, and consumers should know how it could impact them.

Higher interest rates mean lower borrowing power, so whether you’re thinking about buying or selling a home, you might want to start thinking about how those changes will impact you in the future.”

Recently, the Consumer Financial Protection Bureau (CFPB) announced new disclosure rules, which will go into effect this summer. While their activation is still months away, lenders are already weary that it will make the closing process much more complicated, and could possibly mislead consumers.

“New disclosure forms for real estate transactions will completely change the homebuying process as it’s known today,” said Michelle Korsmo, CEO of The American Land Title Association, in response to Consumer Financial Protection Bureau (CFPB) Director Richard Cordray’s recent testimony before the House of Representatives Financial Services Committee.

“As our member companies work to implement these new forms on Aug. 1, we strongly urge Director Cordray to announce a five month restrained enforcement period so that new business processes can be adjusted to comply with these regulations,” Korsmo continued, explaining that as with previous regulatory reform, only when the new forms are in practice will many issues and defects be discovered.

“Unfortunately, we’re already aware of one major problem with the new CFPB forms,” Korsmo stated. “The Bureau’s Closing Disclosure, which replaces the current HUD1 Settlement Statement, inaccurately discloses the fees associated with title insurance premiums for consumers. State law and regulation in half of the United States dictates that consumers must pay title insurance rates that are different than how the CFPB requires industry to inaccurately disclose these fees to the consumer.”

As buying a home may be the largest investment a consumer will ever make, Korsmo stressed the importance of allowing homebuyers to be accurately informed about the total cost of homeownership, including real estate closing fees which, according to Korsmo, are not clearly outlined on the new CFPB forms.

“I’m in support of a delayed enforcement period to provide sufficient time for the implementation process to reveal practical hurdles and to determine that the consumer will be able to also meet the terms of the sales contract,” said Rei L. Mesa, President and CEO of Berkshire Hathaway HomeServices Florida Realty. “The new forms and the regulations will require adaptation in closing practices and protocols, as well as changes in customary closing time frames.”

Mesa continues on to note that if these changes are not implemented correctly from the start, it will certainly lead to closing delays, potential purchase contract defaults, followed by litigation between the parties to the transaction.

“We welcome and support changes that will serve to protect the consumer and enhance the closing process and real-estate-buying and selling experience,” Mesa noted. “These changes, however, affect multiple real-estate-related industries and participants and will require a learning curve that should be without penalties to the service providers.”

Added Korsmo, “It’s critical that Director Cordray and the CFPB staff adjust the disclosure forms prior to Aug. 1 to ensure consumers receive accurate information about their mortgage costs. ALTA and our member companies stand ready to help the Bureau ensure consumers are neither confused nor misled at the closing table.”