All eyes are on the largest generation of adults, Millennials. While their dream home ideals are sky-high, the approach they employ to budgets, goals, home-ownership and renovations shows their well developed practical side.

By Cathy McCabe

All eyes are on the largest generation of adults, Millennials. While their dream home ideals are sky-high, the approach they employ to budgets, goals, home-ownership and renovations shows their well developed practical side.

By Cathy McCabe

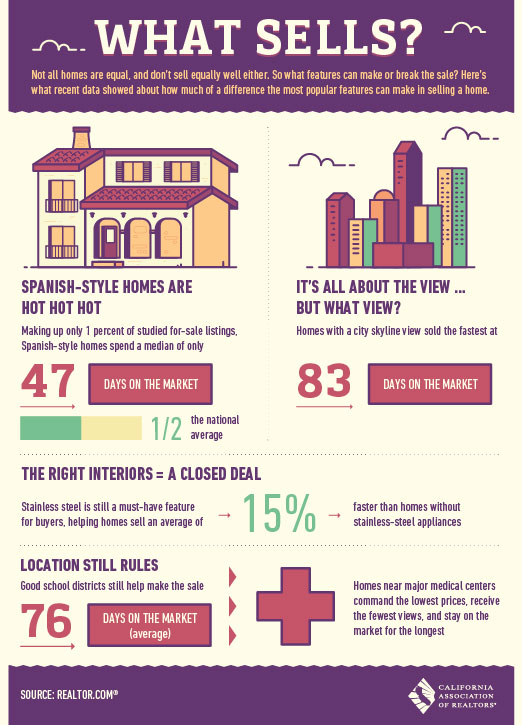

Some of these things don’t really apply in Big Bear, but buyers do love views, as well as stainless steel appliances. What’s the most important thing your Big Bear home would have? Leave us a comment!

Some of these things don’t really apply in Big Bear, but buyers do love views, as well as stainless steel appliances. What’s the most important thing your Big Bear home would have? Leave us a comment!

By Cathy McCabe

Thanks to the National Association of Realtors for putting this infographic together

Recently, the Consumer Financial Protection Bureau (CFPB) announced new disclosure rules, which will go into effect this summer. While their activation is still months away, lenders are already weary that it will make the closing process much more complicated, and could possibly mislead consumers.

“New disclosure forms for real estate transactions will completely change the homebuying process as it’s known today,” said Michelle Korsmo, CEO of The American Land Title Association, in response to Consumer Financial Protection Bureau (CFPB) Director Richard Cordray’s recent testimony before the House of Representatives Financial Services Committee.

“As our member companies work to implement these new forms on Aug. 1, we strongly urge Director Cordray to announce a five month restrained enforcement period so that new business processes can be adjusted to comply with these regulations,” Korsmo continued, explaining that as with previous regulatory reform, only when the new forms are in practice will many issues and defects be discovered.

“Unfortunately, we’re already aware of one major problem with the new CFPB forms,” Korsmo stated. “The Bureau’s Closing Disclosure, which replaces the current HUD1 Settlement Statement, inaccurately discloses the fees associated with title insurance premiums for consumers. State law and regulation in half of the United States dictates that consumers must pay title insurance rates that are different than how the CFPB requires industry to inaccurately disclose these fees to the consumer.”

As buying a home may be the largest investment a consumer will ever make, Korsmo stressed the importance of allowing homebuyers to be accurately informed about the total cost of homeownership, including real estate closing fees which, according to Korsmo, are not clearly outlined on the new CFPB forms.

“I’m in support of a delayed enforcement period to provide sufficient time for the implementation process to reveal practical hurdles and to determine that the consumer will be able to also meet the terms of the sales contract,” said Rei L. Mesa, President and CEO of Berkshire Hathaway HomeServices Florida Realty. “The new forms and the regulations will require adaptation in closing practices and protocols, as well as changes in customary closing time frames.”

Mesa continues on to note that if these changes are not implemented correctly from the start, it will certainly lead to closing delays, potential purchase contract defaults, followed by litigation between the parties to the transaction.

“We welcome and support changes that will serve to protect the consumer and enhance the closing process and real-estate-buying and selling experience,” Mesa noted. “These changes, however, affect multiple real-estate-related industries and participants and will require a learning curve that should be without penalties to the service providers.”

Added Korsmo, “It’s critical that Director Cordray and the CFPB staff adjust the disclosure forms prior to Aug. 1 to ensure consumers receive accurate information about their mortgage costs. ALTA and our member companies stand ready to help the Bureau ensure consumers are neither confused nor misled at the closing table.”