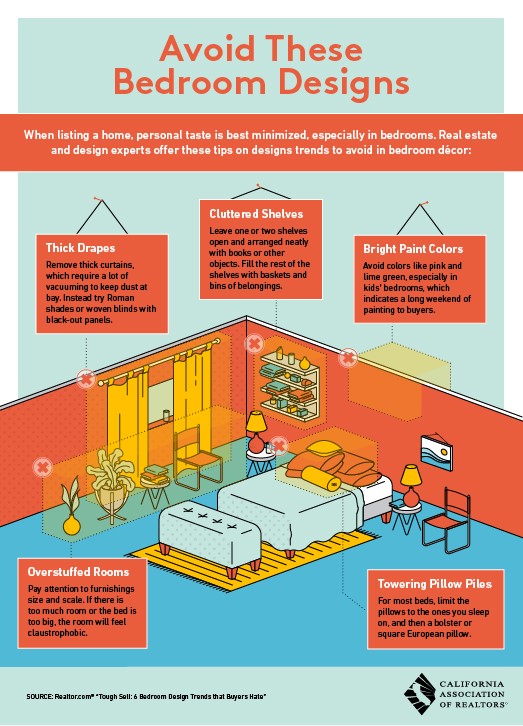

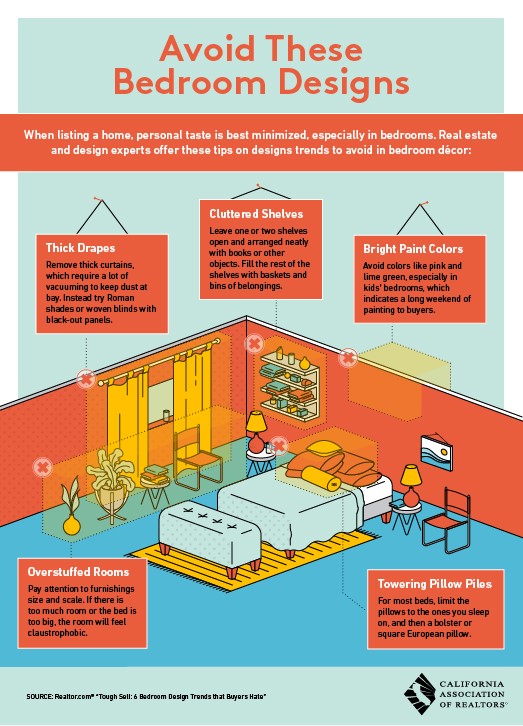

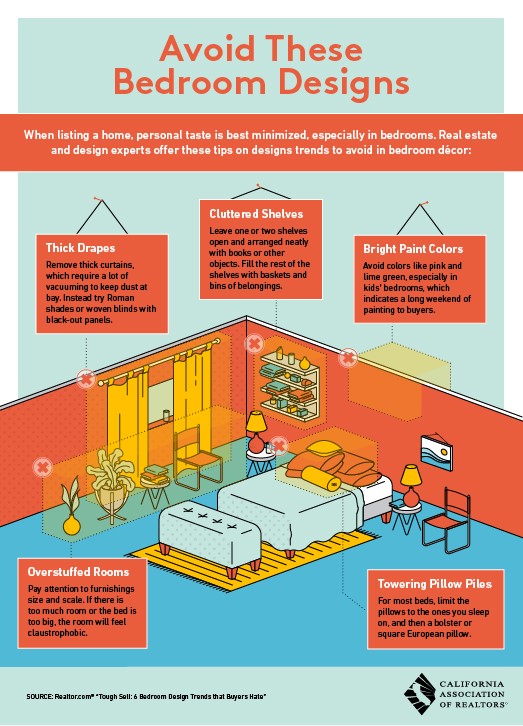

Bedroom Designs to Avoid

By Cathy McCabe

By Cathy McCabe

By Cathy McCabe

Photo Courtesy of Matthew McCabe

Photo Courtesy of Matthew McCabeBig Bear Market Stats as of July 3rd, 2017

By Cathy McCabe

Photo Courtesy of Shelley Sours

Photo Courtesy of Shelley SoursBig Bear Market Stats as of June 2nd, 2017

By Cathy McCabe

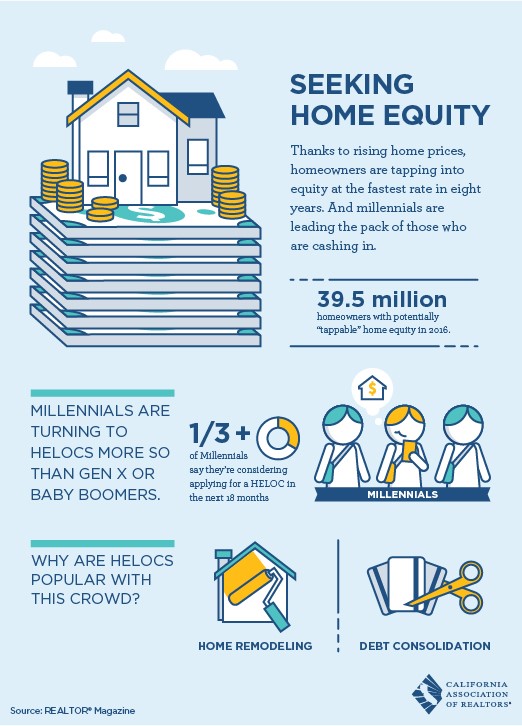

While they are the generation of adults who own the fewest homes, those Millennials who do own are tapping into their equity faster than homeowners of other generations. Why? To consolidate their debt, or renovate their homes.

By Cathy McCabe

Consumer Activism-People using their patronage and support as a way to engage or influence brands and businesses. Are you a consumer activist?

What are some ways businesses can interact with these consumers?